self employment tax deferral covid

You can claim the trading allowance when you complete your tax return on page 1 box 101 on the self-employment short pages SA103S of the tax return. Applicable employment taxes include.

How To Defer Social Security Tax Covid 19 Bench Accounting

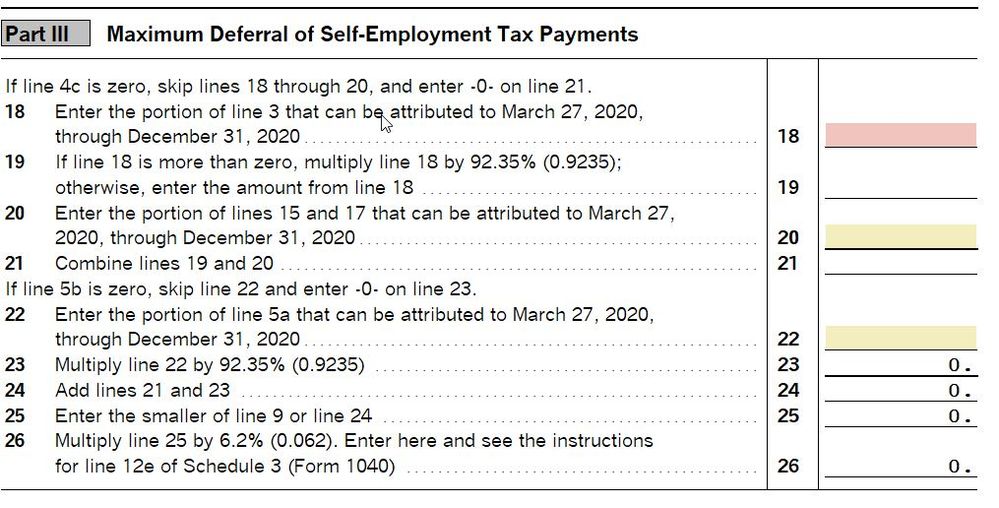

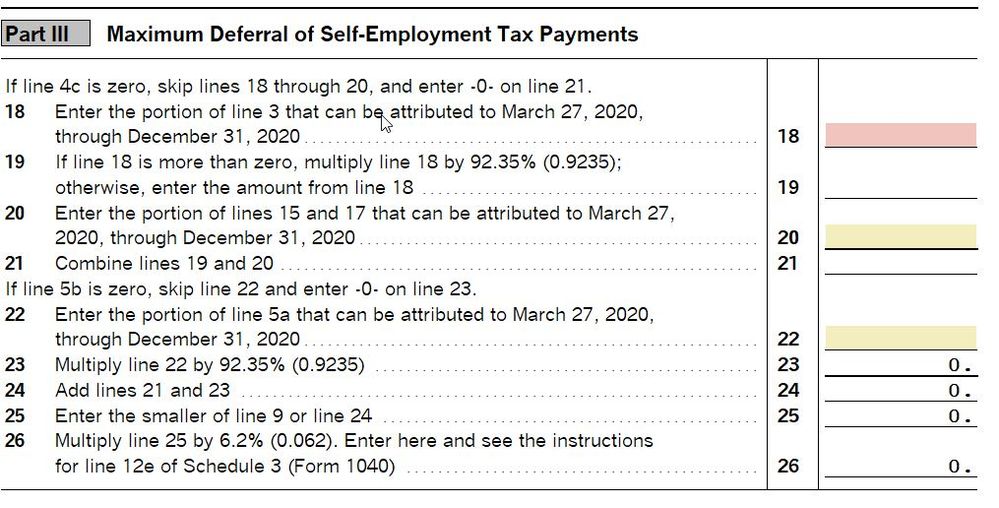

The CARES Act delayed the timing of required federal employment tax deposits for certain employer payroll taxes and self -.

. This may be possible where you owe less than 3000. 2023 under the rules of Sec. All employers may avail themselves of the payroll tax deposit deferral.

The employers share of Old-Age Survivors and Disability Insurance Tax Social Security under. If you file your tax return online you will need to submit it by this date if you have employment or pension income and want HMRC to collect the self-employed tax through your PAYE tax code. As your income is above the trading allowance HMRC say you must register your self-employment and complete a Self Assessment tax return.

If your income is more than 30000 even more tax may be collected through your PAYE tax code. Join the online VAT deferral new payment scheme by 21 June 2021 to spread payments of deferred VAT over smaller interest free instalments contact HMRC to make an arrangement to pay by 30 June 2021.

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

How Do You Opt Out Of Self Employment Tax Deferral Intuit Accountants Community

Self Employed Social Security Tax Deferral Repayment Info

Tax Deferral From 2020 Time To Pay Up Barbara Weltman

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia New Jersey Business Industry Association

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers